10 Amazing Facts About the Money in Your Wallet

/Money. It's a part of our daily lives and it seems like we can’t live without it. We use it to buy food, pay rent, and we save it — or even borrow it — to buy the newest clothing and technology trends.

Throughout history, money has become an indispensable part of society, trade, and commerce. And like history and society, it has come a long way with lots of stories to tell us how it got into our wallets today.

So here are the 10 Amazing Facts about the money in your wallet.

#10 — A Grain of Salt

Starting off with number ten, we travel back to the time of the Roman Empire. We all know that at the height of their civilization, the Romans have introduced many advances and innovations regarding economy and trade. They have also been known to use coins when trading.

However, despite this fact, physical currency is still less valuable than gold and gold is - surprisingly – less valuable than spices. Spices are hard to come by and require a lot to harvest and transport. One of the most expensive spices during that time is salt. Back in those days, salt was mined like precious stones and gems, only affordable to the wealthy. Salt was more than just a spice. It also preserves food! Imagine back when there were no refrigerators, you could make your food last longer with some salt. So, because of its high value, ancient Romans called it Salarium Argentum or “Golden Salt” and origin to the word “salary.”

#9 — Breaking Tables

Fast forward to the Renaissance, is our Number Nine spot. Bankruptcy. The mention of the word can send a chill down anyone’s spines. I mean, who would want to be in a position where you may end up with a terrible credit rating or are unable to manage your finances and be in a mountain of debt?

But bankruptcy did not always have the meaning we associate with it today. Originating in Florence during the Renaissance and at the height of power of the most influential family in the city, the Medici, money lenders would set up tables in the middle of busy markets and bazaars where people could borrow money at a set interest.

At the end of the day, or when the merchant has run out of money to lend, he will break his table in half to close shop. Florentines would call it “Banca Rotto,” meaning, broken table, hence the term “Bankrupt.”

#8 — North Carolina’s Golden Boy

We all remember the Tech Boom and the whole “.com” craze when businesses would greatly invest in almost anything and everything coming out of Silicon Valley. This inflated the American economy, which crashed when the fad faded.

However, the Tech Boom cannot compare to the height of the U.S. Gold Rush in the 1850's. Basically, back then a dozen eggs cost $90.00 of today's money, and the cheapest lodging would cost you at least $300,000!

What’s interesting about the gold rush was when it started in 1803, Conrad Reed, a 12-year old boy from North Carolina, found a 12-pound gold nugget in his father’s farm that supplied all the gold for the country’s mints until 1829. You could say that Conrad Reed was perhaps the richest 12-year old of that time, funding the nation for a whole 25 years!

#7 — Fabric of the Economy

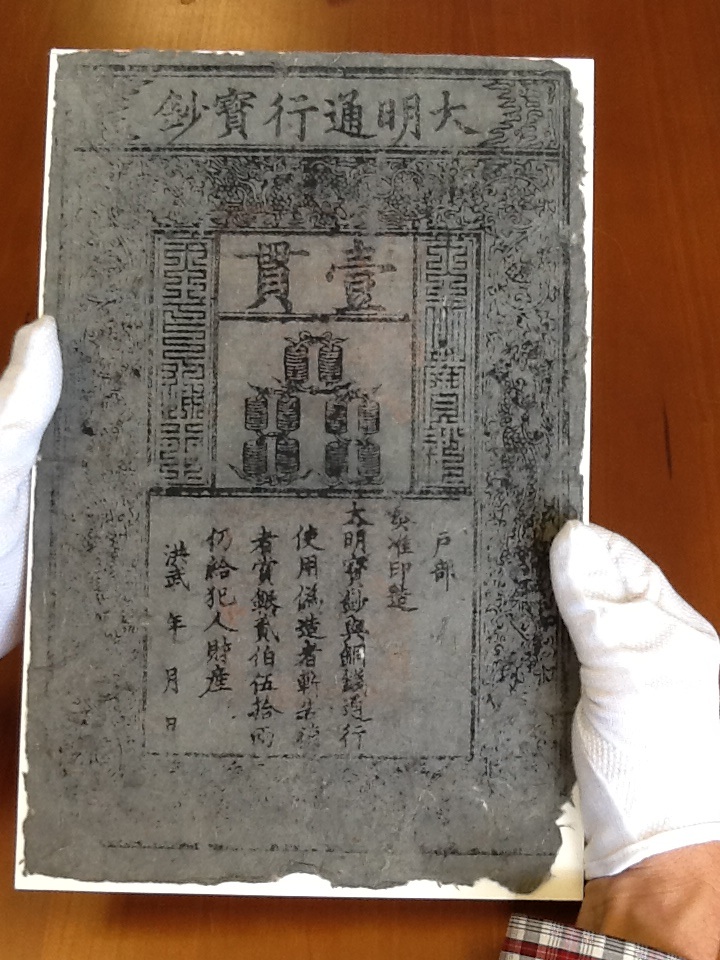

Paper currency, believe it or not, originated in China in 910 AD. In one of his travels to Asia three centuries later, Marco Polo was amazed by the system and noticed that the Mongol Emperor, Kublai Khan, exercised a lot of his power and printed so much bank notes. Unfortunately, due to an excessive amount of paper notes in the region, inflation skyrocketed at an alarming speed, and the paper money system was quickly abolished in the 15th Century and would not return until centuries later.

In the United States, it was a different story. In the 18th Century, people were already using paper currencies with a well-placed system of controlling a number of notes circulating in the market. But that’s not the interesting fact. Back in those days, when paper money was ripped or damaged, people sewed it together with cotton threads. This led to changing today's cash into 75% cotton and 25% linen to endure daily wear and tear.

#6 — Credit Where Credit is Due

Credit Cards are essential. Who could argue against its convenience and, well, inconvenience? A study has shown that there are more credit cards in the United States than there are people but that was not always so when it was first introduced as a form of currency.

It was a blunder that became the inception of the plastic currency. A man by the name of Frank McNamara took a few of his friends out to dinner in 1949. When it was time to pay the check, McNamara discovered that he did not have any cash with him. Because of this embarrassment, he created the first credit card in the history of banking and finance: The Diner’s Club Card.

It was first made out of cardboard and listed 14 participating restaurants on its back during that time. Anyone who wanted to be a Diner’s Club Card member needs only to pay an annual $3.00 fee.

#5 — Vend-O-Cash

Speaking of cards, next to credit cards, another indispensable piece of currency is the ATM card. Over the years it has gone through a lot. First built and introduced in London in 1967 for Barclay’s Bank, the Automatic Teller Machine, or ATM was invented by a Scottish man named John Shepherd-Barron and was based on the concept of a dispenser for chocolate bars.

However, at that time, plastic ATC cards have not yet been introduced or invented, and these first machines only accepted checks laced with radioactive Carbon-14 as a means for it to be identified electronically.

The radioactive check worked pretty much like the magnetic strips in modern ATM cards. Once identified by the machine, the user only has to enter a four-digit PIN to complete the transaction. To subdue the fears of radioactive contamination in humans, Shepherd-Barron claimed that users “would have to eat 136,000 checks” for the radioactive element to give the body negative and harmful effects.

#4 — In God We Trust

The invention and introduction of money made theft much easier, especially between the 16th and 17th centuries before technology. There were no banking systems or Federal Laws in place for the safeguard of currencies, nor secure places to store them.

Local temples, then, became the logical places to store them because of their superior structures, high foot traffic, and would supposedly deter thieves with the fear of God. When money lending slowly became part of the cycle of currency, priests from a Babylonian Temple in 1750, branched out into issuing loans to locals.

#3 — Rich Aromas

Cash gets passed on from one hand to the next on a daily basis. This cycle of transferring does not stop as long as people have to purchase things or pay for services. And with transferring from one hand to another, you can be sure that the money you have may come with a special bonus.

In a recent study, researchers discovered that the most common residue found on US currency is cocaine than on any other currency. And tied for second place are staphylococcus bacteria and fecal matter. For a time, around 1916, people have the option to bring their cash to Washington DC to have it washed, ironed, and reissued.

On the same note, a farm in Delaware is known for mulching almost four tons of US currency into compost. These currencies are either worn out or have been taken out of circulation. In earlier decades, worn out bills are destroyed by piercing or burning to avoid being reissued.

#2 — The Color of Money

Modern US bank notes are printed on a $7 million Swiss Super Orlof Printing presses. One of the machine’s prized features is that it exerts no less than 60 tons of pressure to force and embed ink into the fibers of the note. US bank notes are also known all over the world for their finest, top quality engravings and, of course, its signature green color.

Every currency around the world has a distinct color, and each color has its own characteristics. For the US dollar, green was chosen because it is a color that resists fading, flaking, and discoloration more than any other hue.

This signature green tint also prevents the currency from being counterfeited since fakes can be easily detected due to appearing more “perfect” than the authentic bills.

#1 — The Richest Game Ever Played

Legal tender is printed and destroyed on a daily basis. You would think that at the rate banks produce money since its inception, the world would already be swimming in cash and people would not need to work a day in their lives. But that is not the case because the printing of money is controlled by some factors including gold reserves and inflation.

However, what is surprising about the money that was legally printed and circulated and have ended up in your wallet right now is that it is outnumbered by Monopoly Money. Yes, you heard that right. Parker Brothers, creators of the game Monopoly, revealed that they print about $30 billion worth of the fictitious currency each year. The US government — supposedly — only prints money to replace old or worn-out bills, about $974 million according to CNBC. The iconic board game, therefore, not only out prints the Federal Reserve, it is printing 30 times than what the US government is.

Sources:

http://discovermagazine.com/2009/apr/20-things-you-didnt-know-about-money

http://mentalfloss.com/article/62091/12-fun-facts-about-money

http://www.rd.com/culture/money-facts/

https://www.usatoday.com/story/money/business/2014/07/26/crazy-money-facts/13107853/